The Platform

The World’s Most Modular Digital Lending Platform

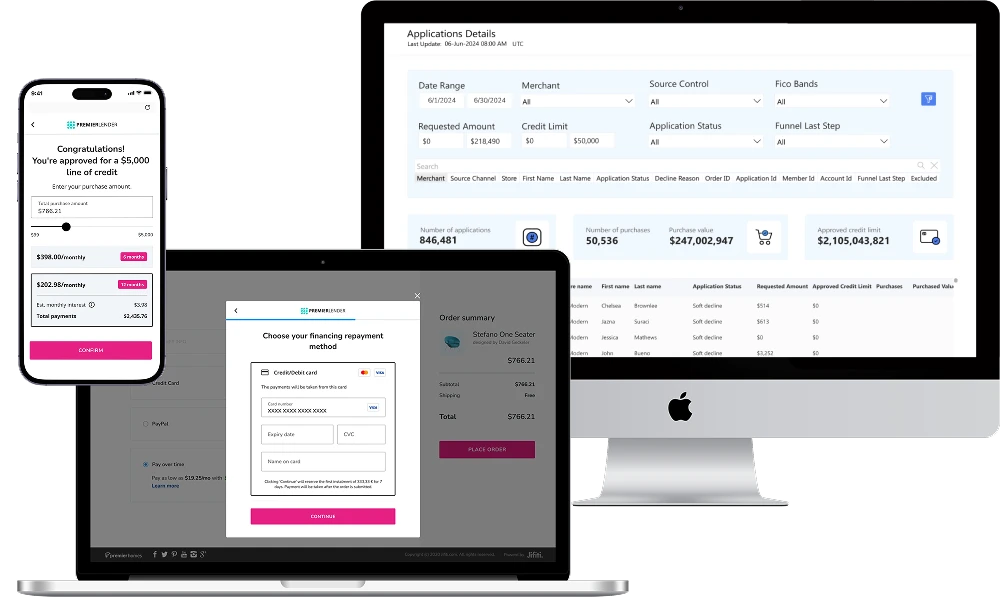

Modernize your lending with our white-labeled lending platform.

Pick the modules you need to digitize and automate any stage of your customer onboarding and lending workflows.

Integrates with your infrastructure. Builds on your legacy.

Our API-driven lending platform seamlessly connects to your existing systems, bringing enhanced, best-in-class digital lending capabilities to your existing tech stack.

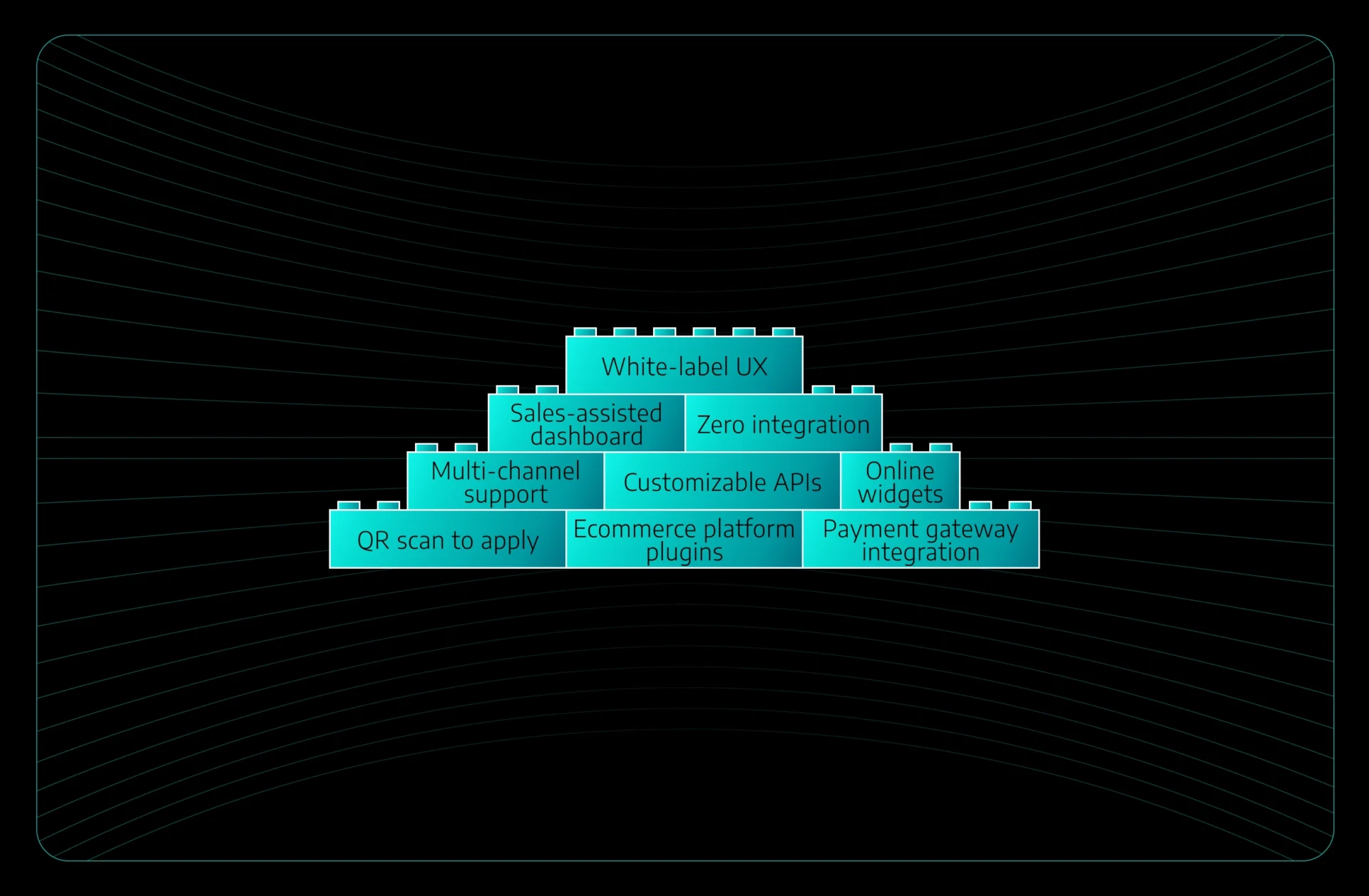

Pick the modules you need

Choose whichever components you need from our modular platform or use them all – we’re flexible that way.

Make your consumer and business loans digitally accessible to both new and existing customers – via your website and app, or embedded in third-party channels.

Each white-labeled lending journey is tailored to the customer, product, channel and use case, creating a seamless path for the customer from initial touchpoint to onboarding and loan origination.

Customer Digital Onboarding

Full functionality for digital business and consumer onboarding, including KYC, KYB, ID verification and more.

Digital Loan Origination System (LOS)

Digitize and automate loan origination from application to decisioning, leveraging multiple data sources.

Third-Party Orchestration Layer

Activate any third-party functionality needed per customer, use case or market, from our best-of-breed ecosystem or providers of your choice.

Loan Management System & Servicing

A configurable LMS for servicing, debt management and reporting across all digital and embedded loan products.

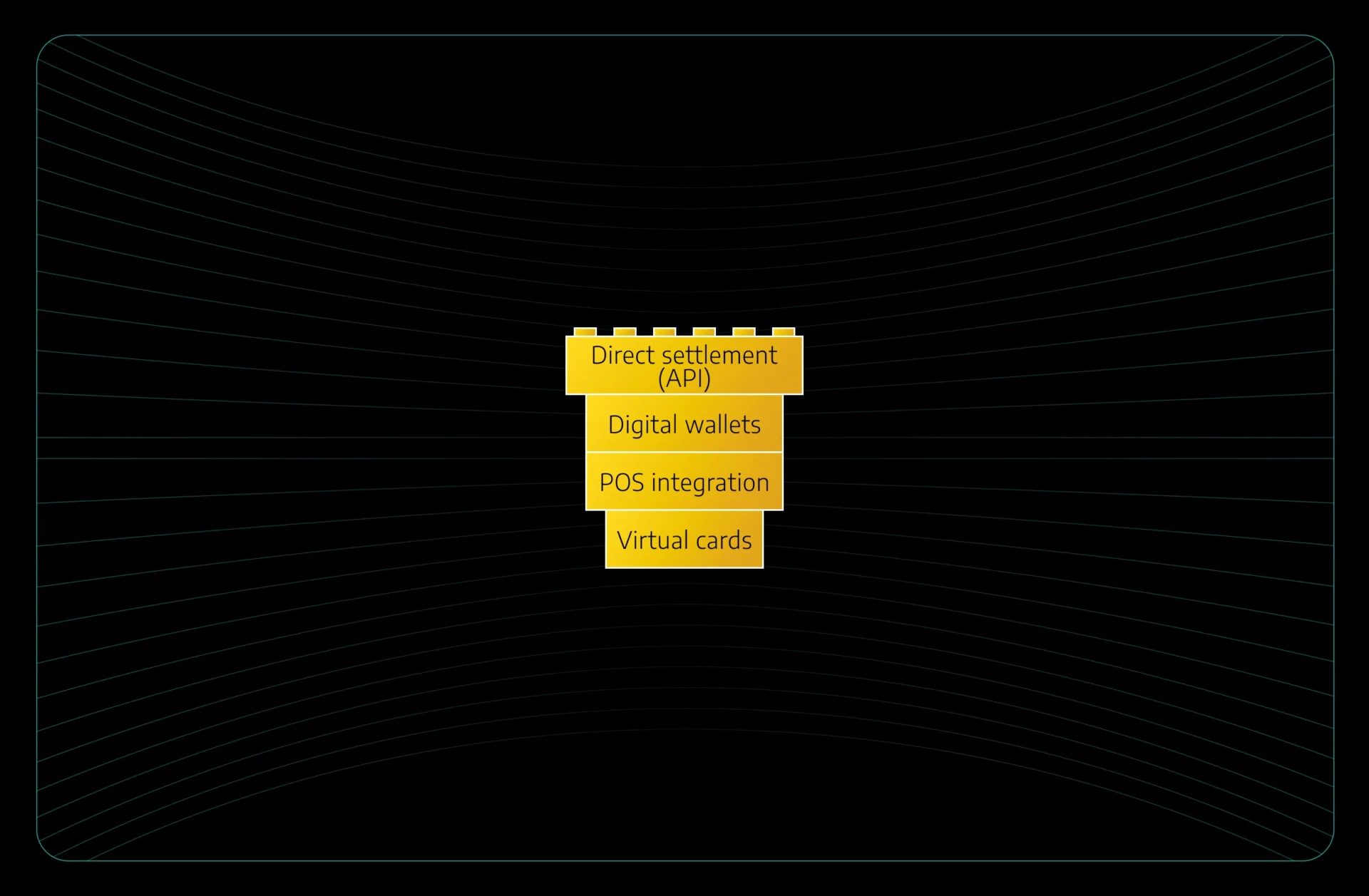

Give your customers real-time access to approved funds, based on your credit terms.

Our platform empowers you with the flexibility to adapt to any customer or partner need and scale your financing programs without limitations.

Built to support multiple fund disbursement methods, we provide technology components for:

- Direct settlement via API

- Web push provisioning to leading digital wallets, including Apple Pay & Google Pay

- Point-of-sale integration

- White-labeled virtual cards

Manage your lending programs based on actionable business intelligence.

Jifiti’s Aurora™ BI platform centralizes all digital lending data in one place – offering real-time insights into channels, markets, adoption, conversion, KPI performance and trend analysis.

The platform includes a customizable lender portal that serves as the control center for your digital lending program, designed to streamline loan program management.

Is it better to buy or build yourown lending tech?

What makes Jifiti different from other lending platforms?

White-labeled

Fully-branded, customizable user journeys

Built for scale

Agility to scale quickly across channels & markets

Modular tech stack

Activate only the components you need

Loan agnostic

Supports all consumer & commercial loans

Global experience

Leverages multi-market learnings & best practices

Controlled by you

You retain full control over core lending logic & data

Compliant by design

Built for regulatory alignment per market

Data driven

Real-time reporting & performance tracking

Third-party orchestration layer

Seamlessly connects third-party services

Collaborative approach

A true technology partner that grows with you

How does Jifiti’s white-labeled lending platform work?

Integrates via APIs into your existing systems

Modernize and enhance the capabilities of your existing tech infrastructure. Designed for easy API integration, seamless implementation and maximum compatibility.

Select the tech components you need

Our modular architecture lets you activate only the modules you need to support your digital lending roadmap. Build a solution that fits today and grows with tomorrow.

Launch on an accelerated timeline

Fast-track your time-to-market with ready-to-use components, streamlined operations, and zero need to rebuild existing systems.

Optimize lending workflows with real-time data

Make informed decisions based on centralized, real-time data. No silos - just a clear, full-funnel view to track performance and optimize every step.